Strange, unknown America: Florida Man, a greek life, megachurches and horrible credit card debt

As an American living in Prague, I’ve enjoyed seeing my homeland through new eyes. Czechs know a lot about America, whether by their own volition or not. As an unofficial ambassador, here is my message: America is strange. Here are four truly American phenomena that might have escaped your attention.

Florida Man

Whether on Facebook or Twitter, you’ve probably come across the long-suffering „Florida Man“. The local Orlando news station, Fox 35 Orlando, dedicates an entire page to him, where his antics range from being identified as a gas station robber after leaving behind his debit card and beating his roommate's racoon with a hammer to shrugging off loosing his arm in an alligator attack. You can browse their archive here. The Florida Man is always mired in irony, misfortune, and high hilarity.

Čtěte také

So, what’s going on in „The Sunshine State?“

There are a few answers.

First, Freedom of Information laws in the U.S determine what government documents the public is allowed to access and vary state by state. The National Freedom of Information Coalition, which hosts data on Freedom of Information act laws in the U.S, notes that Florida has some of the most permissive laws regarding what can be made public to whom. This means that journalists have access to stories that suit the popular „Florida Man“ moniker quicker than the markedly less popular „Virgina Man“ or „New Jersey Man“.

Secondly, Florida is a unique place. The Florida Everglades are a tropical wetland that host animals otherwise exotic to North America, like the infamous alligator. In Florida, it is not unheard of to find a gator in your family pool. The heat doesn’t help either—Iowa State researchers found a direct correlation between a rise in ambient temperature with levels of aggression. Shakespeare, at least understood the Florida Man when he wrote, „For now, these hot days, is the mad blood stirring.“

Krajta tmavá v Everglades. I to je Florida. Zdroj: AP

Florida is also built around attractions that capitalize on the ridiculous, with its reputation built around that of Miami nightclubs and the Walt Disney World megaplex. There was never a shortage of entertainment in Florida, now, it just includes the locals, former President Donald Trump and Gov. Ron DeSantis now included.

Finally, browsing the „Florida Man” archive reveals an unsettling truth. He often embodies the problems plaguing the state. The U.S Housing and Urban Development Department reports that Florida has the 3rd highest homeless population in the country, was ranked by Forbes as being the 5th worst state for mental healthcare, and the CDC notes that it has one of the highest rates per captia of drug overdose related deaths--over 7,231 deaths in 2020 alone.

Čtěte také

The absurd headlines often obscure the true story; Floridians live in a state that refuses to provide care and assistance to the most vulnerable. Perhaps the best explanation is that the „Florida Man“ exemplifies what can go wrong when a population is left behind.

It´s all greek to me

Obscene amounts of alcohol, huge colonial mansions, and strange secret rituals. Welcome to American Greek Life. Don’t let the name fool you; beyond the letters, Greece isn’t involved. In the U.S, Greek life defines the undergraduate party scene. Throughout the country, students „rush“, „bid“, and are „initiated“ into fraternities and sororities dedicated to philanthropy and keeping the party going. The first social fraternity, the Kappa Alpha Society, was founded in 1825. Today, there are an estimated 750,000 active members, and nine million alumni, making up nearly 3% of the U.S population. Greek life is an American institution with an immense amount of power.

A quick primer: Greek life is single sex, with fraternities being exclusive to men and sororities to women. Most Greek letter organizations operates at the national level, with schools having their own „chapter“ of the fraternity. At larger state schools, Greek chapters often have their own housing. Here is a slideshow of Greek mansions.

Řecký život patří mezi jinými i k Alabamské univerzitě Zdroj: AP

Fraternities and sororities are famous for being the backbone of their campuses' nightlife. Additionally, each house has its own philanthropy, with sororities supporting organizations like St. Jude Children’s Research Hospital and the Make a Wish foundation. But, while Greek organizations might dip into other endeavors, they are a social organization.

Čtěte také

So, you want to join a sorority? Going to the involvement fair and signing up won’t get you far. Instead, as immortalized on TikTok as #RushTok, you must sign up for recruitment, or „rush“. For sororities, rush is a strenuous, week-long affair of managing first impressions. Joining your mother’s sorority, or a top house is a lifelong dream of many girls. 2588 girls signed up for recruitment at the University of Alabama last year. With each chapter taking on a new class of about 100 girls, you have less than a 5% chance of placing into any given sorority. Thus, tears are commonplace. Being born a „legacy,“ the child or sibling of a member, is the best way to ensure a spot in your top house.

Outside of legacy status, being wealthy helps, though the two often go hand in hand. Signing up for rush requires a non-refundable $375 fee. At the University of Alabama, if you’re lucky enough to receive a bid, you’ll have the pleasure of paying upwards of $4,978 for new member fees and initiation. Should you decide to live in the mansion for your sophomore year, the cost rises to $8,572. These fees are in addition to your tuition, which is $11,000 for in-state students, and $32,400 for out-of-state students.

Téma bratrstev nedávno řešila třeba University of Southern California. Zdroj: AP

Sorority participation can, and does, get more expensive. At Washington and Lee, a private liberal arts college with the highest Greek life participation in the U.S (73%), states that the average cost for a woman living in sorority housing is 17,538. Nearly 39% of students at Washington and Lee pay full price for tuition. If you’re a young woman opting for sorority housing, and paying full price, then your yearly costs could easily amount to over $83,598.

Čtěte také

Not counting for inflation, and assuming she graduates on time, a family will pay over $334,392 for their daughter to pledge a sorority at Washington & Lee. There is nothing comparable to this in the Czech Republic, where a Czech seeking higher education at Charles University can expect to pay nothing.

Fraternities are similarly priced. There is less pomp and circumstance involved in fraternity rush, with most fraternities hosting informal rush events. Brothers recruit over crawfish boils and cigar nights. For fraternities, rush is not a big deal. „Pledgeship“ is what makes fraternities infamous, the no man's land probationary period of new members.

Being a „pledge“ is dangerous. In most fraternities, „hazing“ is an expected part of pledgeship. 55% of college students experience hazing. „Hazing“ is ritualistic bullying, often amounting to vicious physical abuse of new members. Underclassmen are subjected to brutal beatings, lethal binge drinking, and sexual torture, hoping to prove themselves worthy brothers to their abusers. Many Americans view hazing as a boyish rite of passage despite 44 states outlawing it.

Budova patřící k Florida State University, ve které sídlilo bratrstvo Pi Kappa Phi. Právě zde došlo k úmrtí jednoho z nováčků kvůli nadměrné konzumaci alkoholu. Zdroj: AP

Unsurprisingly, many of these nights turn deadly. Hank Nuwer, the preeminent expert on hazing deaths, only three years since 1948 are free of hazing deaths. Some years include multiple hazing deaths, the deadliest being 2019 with nine known victims.

While underclassmen suffer the most fraternity deaths, the dangers of serious intoxication and dangerous stunts do not discriminate. As an Atlantic article from 2014 notes, drunk students falling from frat house windows happens with surprising frequency. Alcohol, however, is by far the great killer. A blood alcohol concentration above .31% risks coma and death. A sample of the BACs from deceased fraternity men include: Stone Foltz of Pi Kappa Alpha, .350%, Lofton Hazelwood of Farmhouse, .354%, and Adam Oakes of Delta Chi, .419%.

Čtěte také

Another drunk fraternity member might try to keep a dangerously inebriated friend upright. But, he’s unlikely to call for help, as we’ve seen time, and time, and time again. Sandy Coffey, mother of Andrew Coffey who was found to have a BAC of .447%, said her son died in a room full of people. Instead, as was the case with Coffey, fraternity brothers have been caught scrubbing text messages and purposefully destroying evidence before investigators arrive. Comedian Joey Adams got it right when he said, „with friends like these, who needs enemies?“

Then, there's the racism. Most original Greek charters banned nonwhite students from joining, and many remain overwhelming white. Greek life at the University of Alabama was segregated until 2013. Greek life is now integrated, but it would be hard to tell just by looking. Less than 1% of the APA sorority population at the University of Alabama is Black, despite being 11% of campus. Good faith efforts to integrate Greek life chafe against the behavior of its members. It’s not hard to imagine that a Black student would be hesitant to join an organization infamous for its plantation parties, or for chanting the racial slurs on video.

Čtěte také

Finally, fraternities have a sexual assault problem. Fraternity men are three times as likely to admit sexually assaulting someone, and sorority women are 74% more likely to experience sexual violence before graduation. Sigma Alpha Epsilon’s national known nickname is „Sexual Assault Expected“. But, what about a fraternity makes its men more likely to commit a violent crime? Certainly, misogyny and problem drinking exacerbate the problem. But perhaps most insidious is when university administrations refuse punish bad fraternities, in an effort to save their own skin. As Caitlan Flannigan writes for the Atlantic, „Universities often operate from a position of weakness when it comes to fraternities.“

Despite the implicit danger, degeneracy, and questionable moral code, Greek life is evergreen in its power. Still, why would anyone join, agree to be brutalized, pay thousands in dues, and then remain loyal for years to come?

Of course, the most obvious reason, is that they're fun. Greek life means exclusive parties, access to test banks, destination parties, and lots of beer. Many women argue that sororities are empowering and cultivate true sisterhood. For many, college is more the promise of fun and freedom, rather than hitting the books. A keg party in the backyard of ATO has been sold as an essential part of that dream.

Čtěte také

But more important, is that Greek life alumni are powerful. Despite only being 2% of the American population, the Atlantic, citing Alan DeSantis and the Center for the Study of College Fraternity, notes that as of 2014, „Fraternity men make up 85 percent of U.S. Supreme Court justices since 1910, 63 percent of all U.S. presidential cabinet members since 1900, and, historically, 76 percent of U.S. Senators, 85 percent of Fortune 500 executives, and 71 percent of the men in ‘Who’s Who in America.’“ Around rush, many express their interest in Greek life as being professional in nature, seeking the excellent networking opportunity it brings. In all reality, their perception of Greek life in this regard in correct.

Greek life, with its merriments, its exploits, and its depravity, has survived for a nearly two centuries now. In August, students will rush and become part of the next generation of Greek men and women. Looking at history, one can expect that a preventable maiming or death will take place. But so will the keggers—so why should the party stop?

Pastor na podiu i velké obrazovce, kolem něj tisíce věřících. To jsou bohoslužby amerických megacírkví. Zdroj: Profimedia.cz/ČTK

Take me to (the mega) church

Huge cathedrals of the 14th century are the purview of the Czech Republic. Mega churches built in strip malls throughout the 2000s are America’s. This Sunday, over six million Americans will drive to mega churches with stadium parking to hear the word of God amongst thousands of others. While every kind of church imaginable has its place in the American religious landscape, none strike as quintessentially American as the mega church.

Church is no small affair in the U.S, with plenty of congregations dotting any small town’s landscape. But, the difference between a „large“ church versus a „mega“ church comes down to weekly congregants, with the preeminent researcher of megachurches, Hartford Institute for Research, defining a mega church as a Protestant church with over 2000 weekly attendees. By this measure, there are over 1,750 mega-churches in America.

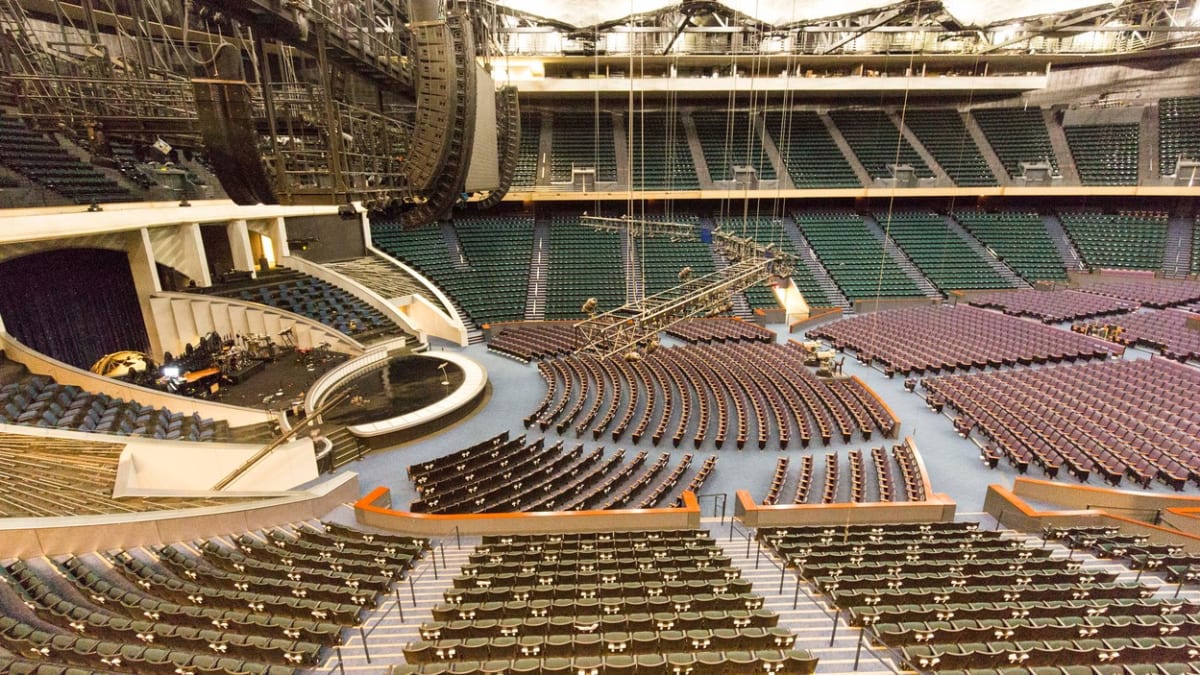

Záběr z bohoslužby protestantské megacírkve Lakewood Church, která probíhá v aréně s kapacitou 16 800 míst. Zdroj: AP

Some mega churches attract enormous numbers to one location. Lakewood Church is the largest campus in America, seating over 16,800 and hosting over 45,000 members throughout different services every Sunday. The sanctuary at Lakewood, formerly a sports arena, has an audience wrapping a full 360 degrees around the stage. Dozens of cameras capture cinematic coverage of Pastor Joel Osteen to project onto the jumbotron screens adorning the stadium. Regardless of whether you’re in the nosebleeds or the front row, you’re guaranteed to hear the word of God, according to Osteen.

The Hartford Institute is quick to point out that it’s not just size that unites mega churches, but also their theology and style. Their pastors are gregarious older men steeped in the tradition of American conservative evangelism. In a sense, they’re the spiritual successors of figures like televangelist Billy Graham, looking to reach the unchurched far and wide. Today, they’ve exchanged fire-and-brimstone sermons on hell for „seeker” friendly theology. A sampling of the largest mega churches’ recent sermons include „Four Truths to Win at Life“, „Filled to the Fullness“, and „The Promise is Coming“. For a newcomer, this message is less intimidating than recounting the doom and gloom of hellfire.

Bohoslužba v podání americké megacírkve Zdroj: Profimedia.cz/ČTK

During a regular week, you can expect expertly executed sermons, professional lighting, Christian pop performances by the choir, and an enthusiastic crowd of believers. Long retired are the hard pews and stuffy chapels of yore. Holidays, however, bring production to another level. Nativity pageants bring to mind parents wrangling their babies into donkey costumes and watching little kids trip over their lines as they proclaim, „the Lord has come“. At mega churches, nativity pageants have ballooned into Broadway level shows, often featuring live animals and fog machines. When the farm doesn’t pick up your calls, perhaps an entire dance troupe is preferable, as Life.Church employed at their „Christmas Spectacular“ in 2021.

Čtěte také

Mega churches are their own kind of cathedral, a building designed to glorify God and impress the laypeople. Far from the style of the simple chapel of the first Puritan churches, mega churches often cost millions of dollars to construct and refurbish. In recent renovations, looking to expand into their fourth building, Cross Church of Northwest Arkansas purchased a gym for $16 million. They intend to use the space for college ministry. Lakewood Church has spent over $100 million to rent, renovate, and eventually purchase their former sports arena from the City of Houston.

It’s difficult to determine what most churches spend their tithings on, given their tax-exempt status in the U.S. From the information self reported and outside studies, the average mega church budget is 6.5 million a year. Clearly, building maintenance takes up a great deal of that budget, but the biggest cost for mega churches is staff. The nursery staff may not be millionaires, but questions abound about the ultra charismatic pastors. Preachersnsneakers pokes fun at the often extremely expensive sneakers (often the famed Yeezeys by recent evangelical convert, Kanye West), watches, jackets, and more of America’s wealthiest pastors.

Aréna pro bohoslužby Lakewood Church Zdroj: Profimedia.cz/ČTK

It’s almost impossible to imagine a church comparable to an American mega church in the Czech Republic. Some Catholic parishes might pull in similar numbers on holidays. Still, Lakewood is over seven times as large as that of the St. Vitus Cathedral, the largest church in the Czech Republic. Moreover, Protestants are less than 1% of the Czech population which stands in stark contrast to that of the U.S, where Protestants are close to half of the public. But, for Czechs craving a bit of that mega church experience, you could always take the train to Berlin, where Saddleback opened a branch in 2013. Their numbers are about half that of the average American mega church at 1,000. Still, it’s many times larger than most Protestant congregations in the Czech Republic. Perhaps Saddleback will „plant“ a church in Prague next.

Čtěte také

Credit card debt

Capitol One’s memorable catchphrase asks, „what’s in your wallet?“ Is it an exclusive, invitation-only „black card“, like that of the Centurion Card from American Express, which totes a 24/7 concierge service and $5,000 annual fee? Or is it a Garfield Visa with Rewards by Commerce Bank, with a picture of everyone’s favorite ginger feline friend and modest cash back on lasagna purchases? More likely, it’s a credit card through your bank, or perhaps an airline rewards card with valuable travel miles.

That is, if you have a credit card in your wallet at all. According to the World Bank, as of 2021, 29% of adult Czechs and 66% of Americans have at least one credit card. With credit cards becoming first available in the U.S during the 60s, Americans have a few decades of credit card usage under their belt. Today, Americans collectively owe almost 1 trillion dollars in credit card debt.

For all of their „rewards“ and „benefits“, credit cards pose an immediate financial risk for the ill equipped. The Federal Reserve notes that half of credit cards in use have carried a balance, meaning they accumulated interest and saddled the user with more debt. The average amount of credit card debt in America is $5,733.

States with the highest credit card debt per user are CN, NY, and NJ, with an average of $9,205 https://t.co/vboyoHyKr7 pic.twitter.com/gOvmZYk0Gv

— Brad Thomas (@bradthomas) July 24, 2023

It’s not just the high interest rates and the accumulating debt that hurts. In America, all borrowers are assigned a credit score, often called a FICO score. Credit scores are a numerical evaluation of a borrower’s reliability and are a number created by banks to standardize the lending process. All creditors report credit history—so late payments, abandoned accounts, limited credit history, and high borrowing will all hurt credit scores, typically for years to come regardless of efforts to improve the score.

Credit scores are between 300 to 850, with higher being better. Anything above 780 is considered excellent, and you’ll be eligible for favorable loans and great interest rates. Borrowers with a score below 670 will struggle to secure affordable interest rates and may find themselves unable to open cards, get a mortgage for a new house, or secure auto loans. Which, is bad news for the third of Americans with credit below 670. Worse than a bad credit score is having no credit score at all, of which there are 45 million Americans, or 22% of Americans.

Beware: Consumers have amassed high credit card debt at 20% + interest rates, while personal savings rates are historically low pic.twitter.com/nowkdub6J6

— Bravos Research (@bravosresearch) July 23, 2023

Credit card companies and mortgage lenders aren’t the only ones peeking at credit scores. Landlords run credit checks, and renters who come up short are either turned away or forced to find a guarantor. Employers can run credit checks and reject job candidates if they tote a subprime score.

Čtěte také

Suppose a family’s finances take a temporary downturn (consider unexpected job loss, medical debt from health issues, divorce, crime victimization, or any other number of everyday catastrophes). If they’re forced to take on additional debt, or make late payments, their credit score will immediately reflect that. Once back on their feet, it can still take years for credit scores to rise. Poor credit becomes a kind of financial ghoul, intent on keeping Americans out of affordable housing and better jobs.

Of course, this is not to say that all Americans are drowning in credit card debt or that there are no Czechs facing certain financial ruin of their own. However, historically, Czechs have been debt adverse and still have some of the lowest debt to income level in Europe.

Today, credit cards are becoming increasingly popular in the Czech Republic. For those looking to reap the rewards that many advertise, it’s important to be knowledgeable the function and risks of credit cards. The well-informed will benefit. But, take note of American credit card debt as a cautionary tale.

If you’re in the market for a credit card, be sure to shop around for the best interest rate before committing, and make sure you pay off your balance in full every month.

While you might not have to worry about a FICO score following you to the next job interview, debt can still easily snowball and keep you out of your dream apartment. If you’re in the market for a credit card, be sure to shop around for the best interest rate before committing, and make sure you pay off your balance in full every month. This way, you can cash in your airline miles without worry.